By intellircm 21st Jan 2022 Blog

Medical billing is the arduous payment process for medical services provided by a third-party payer - most commonly represented by an insurance company. The entire procedure involves step-by-step processing, commonly referred to as healthcare revenue cycle management. The process includes many different modifications to build a flexible budget and financial policy for the medical organization to attract more patients. Given the numerous steps in data processing, the entire medical billing cycle can take several days to a few months and may require some effort before both parties come to a mutual agreement. So let's examine each stage of the challenging medical billing process and find out why it requires thorough analysis.What Steps Does the Medical Billing System Compose?

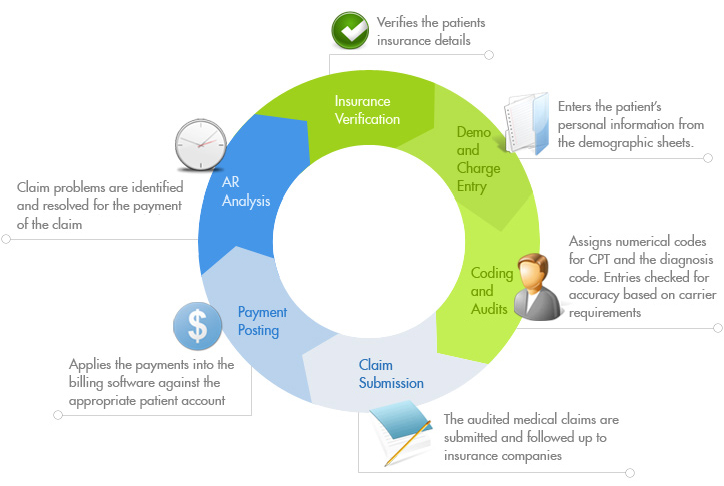

Although medical billing procedures can be confusing due to many steps, this basic guide will help you to better understand the intricacies of each phase and make it easier to obtain health insurance coverage.Step No1: Patient Health Plan Enrollment

The whole process commences when a medical institution enters into a contract with an insurance company to guarantee coverage for medical expenses. Meanwhile, direct interaction between the patient, medical entity, and the payer starts once the former schedules an appointment with a physician at a medical institution. After the visit, a medical institution representative updates the patient's medical record and submits data regarding the services.Step No2: Insurance Eligibility & Benefits Verification

The insurance providers are entitled to modify the healthcare plans and coverages. Thus, patients who have just enrolled in health insurance plans and those who have used insurance coverage on a long-term basis should verify the actual status of their coverage and eligibility before each appointment with the practitioner. Besides, each medical facility features an individual policy for processing and collecting payments from patients. Therefore, the medical care recipients should double check all the terms and conditions before they get medical services, to avoid unexpected expenses.Step No3: Performing Medical Coding and Formatting

Once a physician has diagnosed and prescribed treatment and medications, medical coders, whose services are on high demand, apply special coding software to encode the diagnosis and treatment and submit the data to an insurance company. An alphanumeric code based on a standardized system helps the insurance company protect the confidentiality of data when transmitted to the insurance company and calculate reimbursement for medical services. For example, the US healthcare system applies the Current Procedural Terminology Manual (CPT) to encode procedures, while the International Classification of Diseases (ICD-9) guidelines are used to encrypt the patients’ diagnoses. Some e-health payment programs can assign these codes automatically by extracting the information directly from the medical record. However, the bill is often manually rechecked by a healthcare provider to ensure accuracy and full compliance. Further claim formatting is performed utilizing digital software services and electronic data exchange to send the claim file to the payer directly or through a clearinghouse. In addition, some medical claims are sent to payers using paper forms that are entered manually or with automatic recognition software, or RCM services. Valid diagnosis codes describing the patient's symptoms or conditions, and valid procedure codes describing the patient's treatment method, help to expedite claim adjudication and ensure that the insured receives all the valuable benefits covered under the patient's insurance plan.Step No4: Submitting and Adjudicating Claims

Once the medical provider completes the forms and sends the paperwork to the insurance company, savvy medical claims adjusters initiate data processing in order to start reviewing the claim. For claims with large amounts of payment involved, the insurer usually employs experts of the top class to review claims and assess their validity for payment using criteria for patient eligibility, provider credentials, and medical grounds. Even skilled insurance company representatives can only accurately evaluate the expenses if they receive correctly entered codes. There are three alternatives to the outcome of claim resolution:- accepted claim means that all expenses are covered according to the insurance coverage plan

- rejected claim needs data correction and further review

- denied claim results in healthcare means the insurance provider refuses to cover the expenses