By intellircm 15th Nov 2022 Blog

As assessment and diagnostic tools, it is tough to overemphasize the importance of your healthcare practice’s accounts receivable reconciliation, also known as accounts receivable (AR) aging reports.

These standard reports offer a comprehensive impression of a practice’s financial status along with Insurance and patients' aging.

There are several reasons accounts receivable aging reports are essential to your revenue cycle management. We're going to define accounts receivable aging reports and their benefits in this article. We'll also discuss how automation can make generating these reports nearly effortless.

What are Accounts Receivable Aging Reports?

Your healthcare practice can create these reports to reveal balances owed by insurance companies, vendors, patients, and other practitioners and the time each claim has been outstanding. They help you evaluate the overall financial health of your business.

The collection team can use accounts receivable aging reports to calculate how long claims have gone unpaid and the total of any unpaid services. Use it to determine patterns and develop collection strategies.

For example, if an insurance company consistently pays claims late, it could indicate other underlying issues, like payment policy changes. If they have new processes for documenting and paying claims, your practice's claims to them might continually be late until they iron out the kinks.

Accounts receivable aging reports will help you develop a strategy for getting them to pay on time, like automated email reminders.

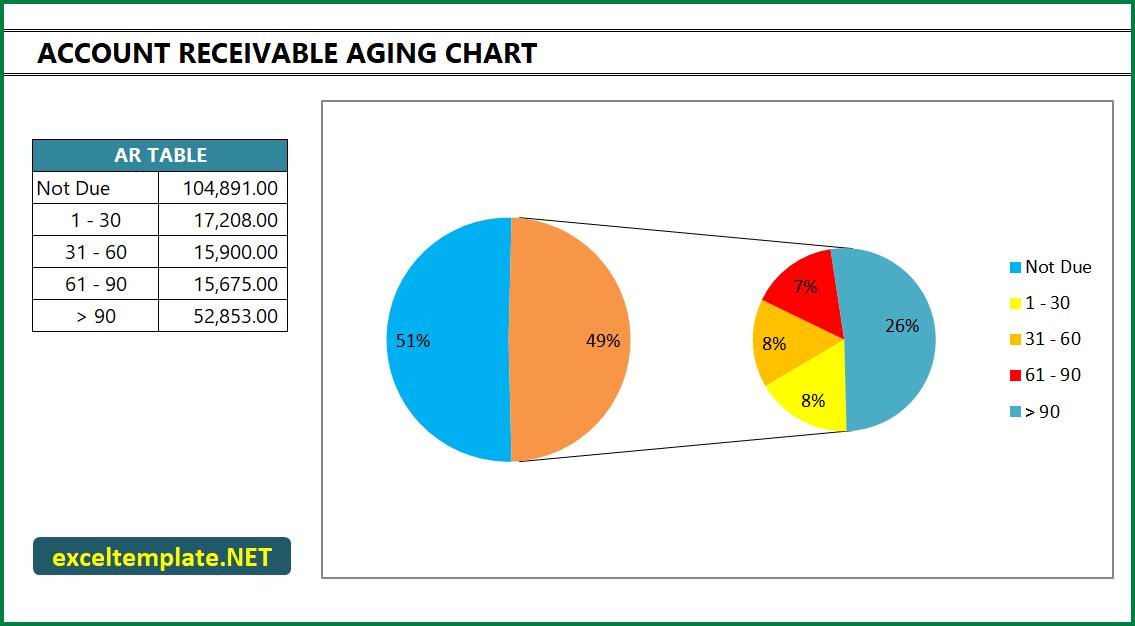

Divide them into categories, like 30 to 60 days, 60 to 90 days, 90 to 120 days, etc., to determine account delinquencies by age. This helps you stay on top of your old and important claims before they go out of timely filing, improves the practice’s cash flow, and enhances short-term forecasting for collections.

Run accounts receivable aging reports routinely to glean vital data about your facility's financial health. Make a list of which clients you need to follow up with and when. Or place the data in charts for collection forecasting.

Reasons Accounts Receivable Aging Reports are so Important

In 2020, healthcare costs in the U.S. reached an all-time high of over 19% of its gross domestic product (GDP). Both private and public healthcare spending in the U.S. is much higher than in other countries, so many patients are unable to pay on time.

An accounts receivable aging report will help you manage these payment delinquencies. Here are a few reasons these reports are so important:

- Shows patients and providers that you are on top of your billing and collection process

- Helps you stay in contact with patients or providers to inform them that delinquencies are unacceptable

- Determine which patients or providers struggle to pay

- Gain insights into payment patterns to provide resources for patients who need assistance

- Reduces the need to write off bad debts by helping you determine whether to sever ties with a particular insurance provider due to late payments

- Identifies internal versus external issues with your healthcare company's AR process

- Enables you to evaluate payment terms with patients and providers to negotiate different terms and make any necessary changes

Why Automation is Important to Accounts Receivable Aging Reporting

Automation offers practical tools that drive digital transformations for organizations in every sector. They offer more efficient accounts receivable management.

Many AR-centric platforms support automated report functions because of the great advantages they deliver to a healthcare organization’s AR workflows and overall efficiency:

Access Reports Instantly

An automated solution streamlines your practice's collection processes by quickly drawing and organizing data according to pre-set parameters. Spend less time building reports and more time reviewing them.

Greater Payment Forecasting Accuracy

Accurately oversee cash flow accounting, customized allowances, and behavior monitoring for doubtful accounts. Additionally, automation removes human elements, reducing errors.

Reporting Time Reduction

Manual collection processes are tedious and time-consuming. It produces poor workflow efficiency and frustrates your team. Over 40% of workers say they spend at least two hours daily on manual tasks. Leverage automation to eliminate these manual tasks.

Stay on Top of Accounts Receivable with IntelliRCM Technology

Healthcare practices need to periodically generate accounts receivable aging reports to create a workable operating budget. These reports allow you to identify which invoices are still open, providing analysis of the financial reliability of your patients and the other practitioners with whom you do business.

Aging accounts receivable is inevitable for most healthcare providers. At IntelliRCM, we offer a software solution collections teams can use to get outstanding invoices paid. Our accounts receivable and revenue cycle management automation delivers the best way to manage cash flow, accounts payable, and receivable.

Contact us to learn more about AR aging reports. Have questions? Give us a call today to speak to one of our friendly professionals.